Legalized Double Plunder

The Fiscal Alchemy of Modern States

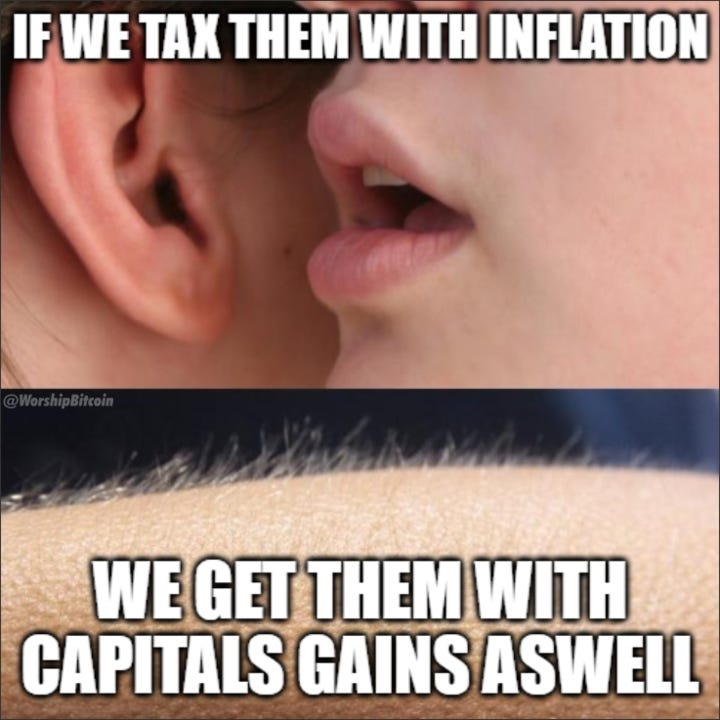

The meme satirizes a genuine economic distortion: inflation taxation compounded by nominal capital gains taxation—a mechanism that extracts value twice from the same source.

When a government expands the money supply, the purchasing power of every existing unit declines. This dilution functions as an invisible tax: a transfer of value from savers to the issuer of new currency. It is the first stage of loss, hidden in the arithmetic of prices rather than imposed directly by law.

Investors respond rationally by moving wealth into assets that better preserve value—equities, real estate, or alternative stores like Bitcoin. As the currency weakens, these assets appear to rise in nominal price, though their real value may be unchanged. When those nominal gains are later taxed as if they represent true profit, the same wealth is reduced again, this time by explicit taxation.

The result is a kind of double taxation through illusion: first through the erosion of purchasing power, then through the taxation of the inflation adjustment itself. The accounting system recognizes the number, not the substance.

This is not a conspiracy but a structural blind spot. Public finance operates on aggregates—price indexes, monetary bases, growth rates—that treat nominal changes as real data. These abstractions are useful for coordination but dangerous when reified into measures of fairness or justice. Once policy mistakes the map for the territory, it begins to act upon symbols rather than conditions.

The deeper problem is epistemic: governments and economists often assume their statistical instruments capture real wealth and real prosperity, when in fact those instruments only approximate them. By acting on nominal measures, policy ends up punishing prudence and rewarding debt—an inversion of economic virtue.

Inflation, in this sense, transfers value silently. Nominal capital gains taxation formalizes the process. Together they illustrate how modern fiscal systems can produce extraction without intent, through the inertia of their own definitions.

Inflation creates the mirage of increased wealth; capital gains taxation harvests it.